Trend of IPO opening prices in the first 20 days after listing. Average... | Download Scientific Diagram

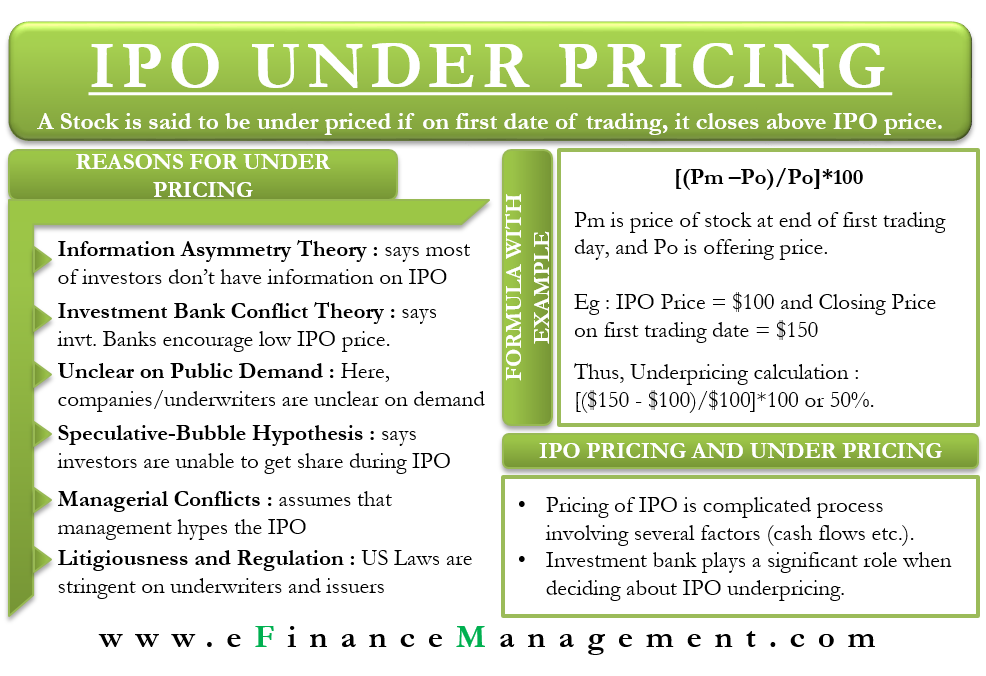

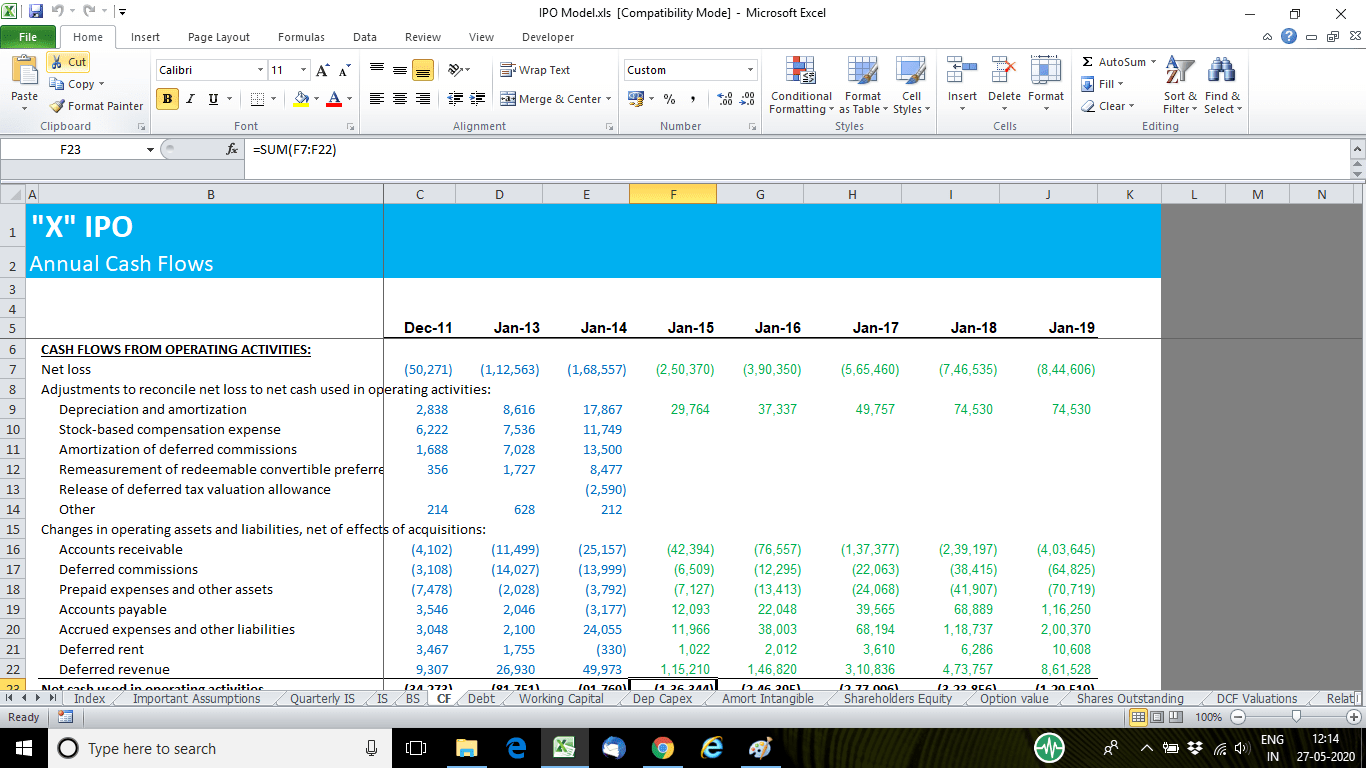

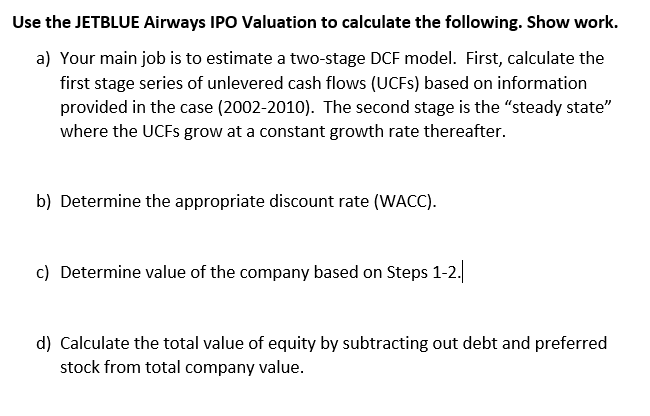

Formula Sheet - Formula Sheet 1. IPO valuation Valuation based on the DCF method: 1 1 where: V = total value of IPO company WACC = Weighted Average Cost | Course Hero

:max_bytes(150000):strip_icc()/Market-Capitalization-ba038aeebab54f03872ead839a2877a4.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Pre_Money_vs_Post_Money_Whats_the_Difference_Sep_2020-01-0a7184fe21204088baa6bfaa52db3217.jpg)